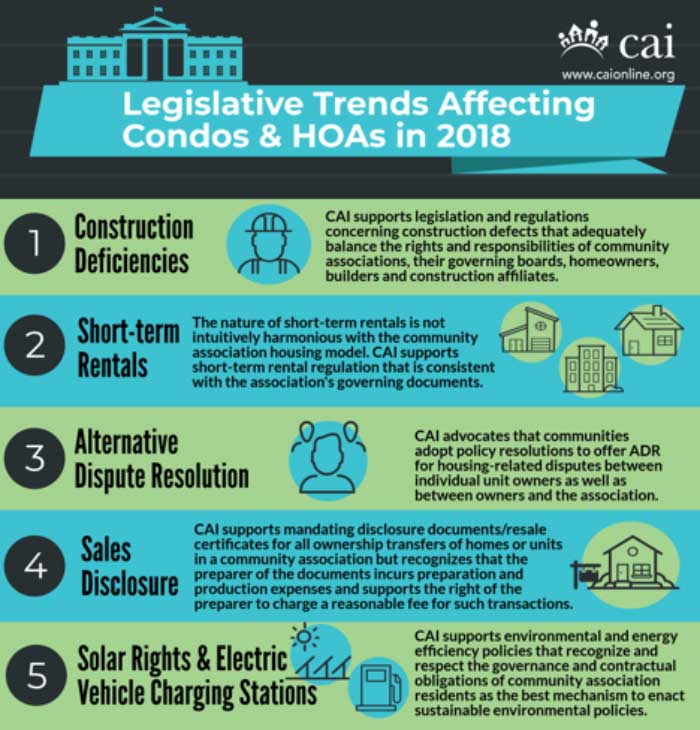

Legislative Trends Affecting Condos and HOAs in 2018

2018 Advocacy - As members of the HOA industry it is so important to stay up to date on issues that affect us and our Communities. CAI lets us know what they support for upcoming Legislation. Please see this link to sign up for the Advocacy Emails from CAI National. https://www.caionline.org/Advocacy/Pages/default.aspx Please research the pending [...]